In Brief

The broadcasters’ VOD services were the original streamers, now they’re the beating heart of the expanding world of connected TV. BVOD advertising in the UK is rapidly growing, with investment predicted to increase by 4.4% in 2023, according to Advertising Association/WARC figures. Yet, until now, there has been relatively little large-scale evidence for the effectiveness of BVOD advertising. This study – in collaboration with Channel 4, ITV, and Sky – filled that knowledge gap. It’s the most comprehensive exploration of broadcaster VOD advertising to date.

Methodology

This large-scale, multi-mode series of research studies brings together ethnographic research from Acacia Avenue, econometric analysis from Gain Theory and GroupM and advanced data science evaluation from PwC.

Key findings

- Driven by screen size, shared viewing, and an appreciated value exchange, broadcaster VOD delivers advertising engagement.

- Campaigns that use both linear TV and BVOD are more effective than linear alone.

- BVOD is the least risky video advertising investment, offering the most predictable returns.

- Driven by its ability to reach the valuable ‘middle tier’ of viewers, BVOD adds, on average, a 4% increase in Adult (16+) reach to a linear campaign, a 6% increase for Adult ABC1s, and an 8% increase for 16-34s.

In Depth

Background

In recent years, BVOD has become a significant part of the video world, with over £800m spent on this medium in 2022 and predicted to grow by 4.4% in 2023. With Broadcaster VOD (BVOD) viewing steadily growing for the last decade, especially for younger audience, it is now the premium, beating heart of the connected TV world.

This growing sector has brought a growing appetite for evidence on its efficacy and clarity on the contribution it makes alongside linear TV, which formed the basis of this research.

This study aims to provide an understanding of the role BVOD plays in people’s lives – including how it fits within wider online video consumption. Incorporating analysis from a wide range of BVOD campaigns, backed up with data science, it provides practical guidelines for how to best use BVOD within a wider video communications plan and gave an understanding of the role it plays in ad-driven profit return.

Methodology

The study brought together a wealth of different research skill-sets and techniques:

- Acacia Avenue conducted an ethnographic and videographic study of 30 households to understand the way that people are watching different types of video, and to specifically focus on the characteristics of their advertising experience and engagement.

- Gain Theory, EssenceMediacom, Wavemaker and Mindshare pooled their econometrics databanks to analyse £1.1 billion of advertising expenditure across video channels (linear TV, BVOD, social media and online video, 2018 to mid-2021) to help understand the role for BVOD.

- PwC UK combined data from Barb’s Focal Meter and 1,259 campaigns measured by CFlight (July 2021 to August 2022) to evaluate BVOD viewing patterns and reach contribution. They applied advanced data science statistical techniques and machine learning to unpick the variables that impact incremental campaign reach.

Findings

Context Matters

Acacia Avenue’s ethnographic and videographic part of the study revealed that what viewers take from video advertising is affected not only by the creative they see but also by the platform/environment and the device they see it on.

Three key themes emerged:

- Ad to content value exchange Viewers like the predictability of established advertising rhythms and patterns and a fair value exchange in terms of the calibre of production and time spent watching content vs. the amount of ads. If that value exchange falls short, viewers will move on or actively avoid the ads.

- Advertising environment Screen size is the main driver of a shared viewing experience. Shared viewing creates talkability and a more immersive, impactful viewing environment. Device-based advertising can be effective when correctly targeted, but the high volume of unknown or smaller brands on social media can negatively affect perceptions. Randomly placed ads, or ads disguised as content in social media, create mistrust and frustration.

- Perception of targeting Ads on a TV screen aren’t scrutinised for their relevance - as long as they resonate with the viewer, they’re accepted. Ads on a device are scrutinised for their personal relevance and are questioned if they fail at this. BVOD content is actively sought out by viewers, is trusted and respected.

Mainly watched on a big TV screen, it commands attention and provides an immersive mindset. Ad engagement within BVOD is strong; driven by clear signposting and an understanding of the value exchange brought over from linear TV.

Better together

The joint analysis by Gain Theory, EssenceMediacom, Wavemaker, and Mindshare found that campaigns that use both linear TV together with BVOD can be up to 10% more effective than linear alone at delivering ROI.

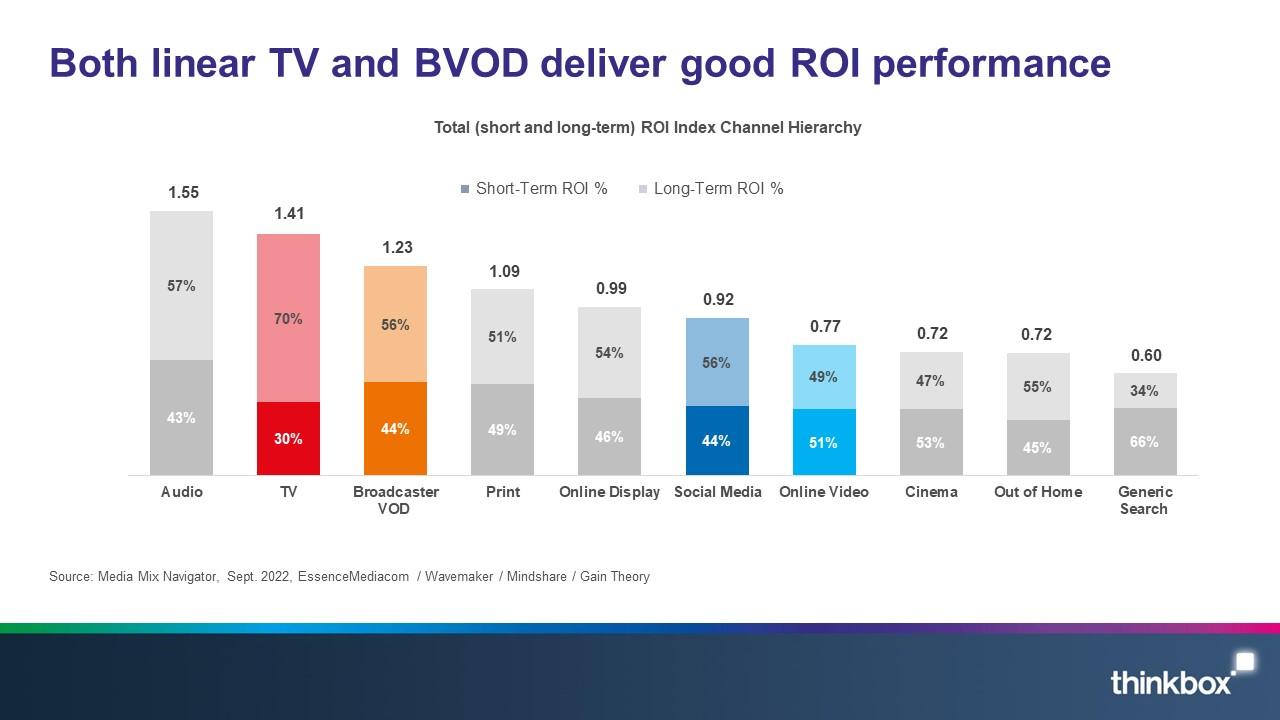

Similarly, both linear TV and BVOD deliver good ROI performance. When looking at both the short term and long term ROI by channels, Linear TV and BVOD perform favourably delivering the highest ROI index, after Audio.

BVOD is the least risky form of video investment

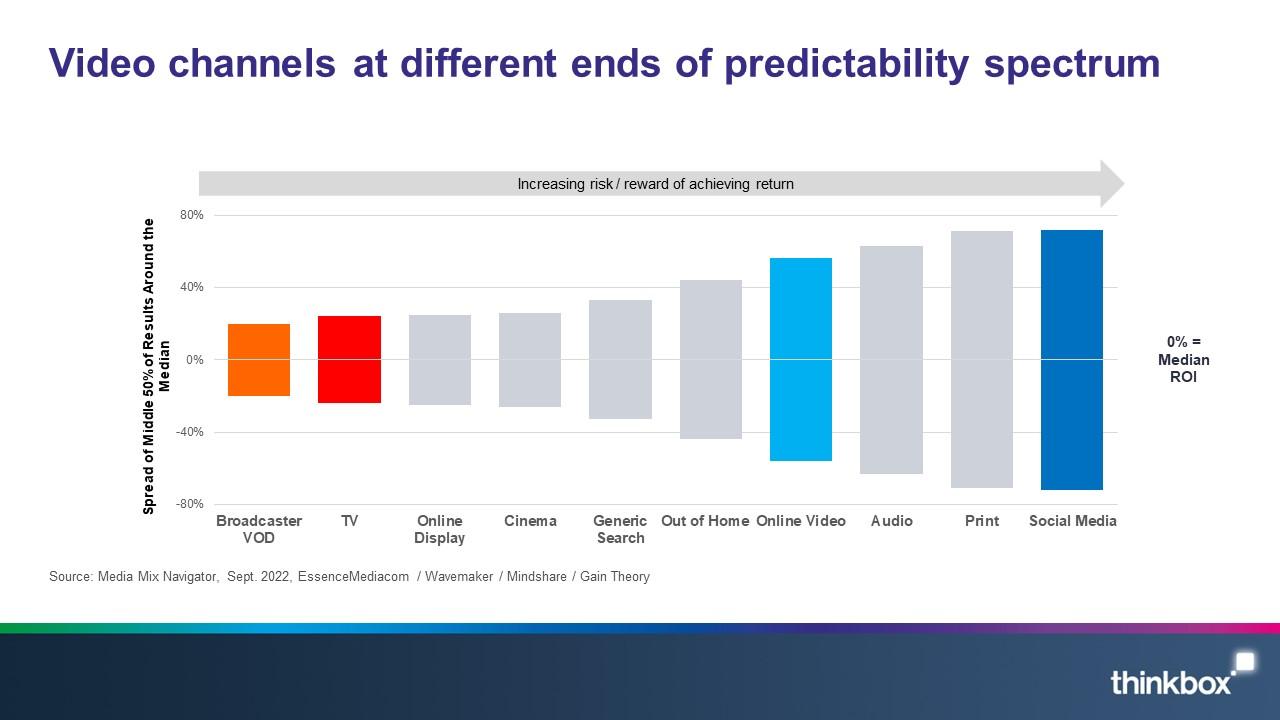

Gain Theory, EssenceMediacom, Wavemaker, and Mindshare also found that the variability of returns differs significantly across different forms of advertising. This essentially indicates the risk of investing in different channels based on the predictability of their returns.

The median brand ROI in the databank for each channel is represented by the zero across the middle. To assess the predictability of each channel, the analysis looks at how spread out the different brand ROIs are for each channel in comparison to that middle brand. Basically, the bigger the bar, the bigger variance there is between the best performer and the worst performer – so the greater degree of risk. Outliers have been removed.

BVOD is the most predictable (therefore least risky) channel, delivering 20% of variance compared with the median return. This was closely followed by linear TV with a variability of 24%.

It’s worth noting that high variability works both ways: although it involves greater risk, there is the possibility of achieving a much higher than average ROI (as well as a much lower one).

BVOD builds incremental reach

PwC’s analysis found that, on average, BVOD adds a 4% increase in incremental Adult (16+) reach to a linear TV campaign, a 6% increase for Adult ABC1s, and an 8% increase for 16-34s.

Among the top performing 10% of campaigns, the percentage increase rises to 9% for Adults, 8% for Adult ABC1s, and 11% for 16-34s.

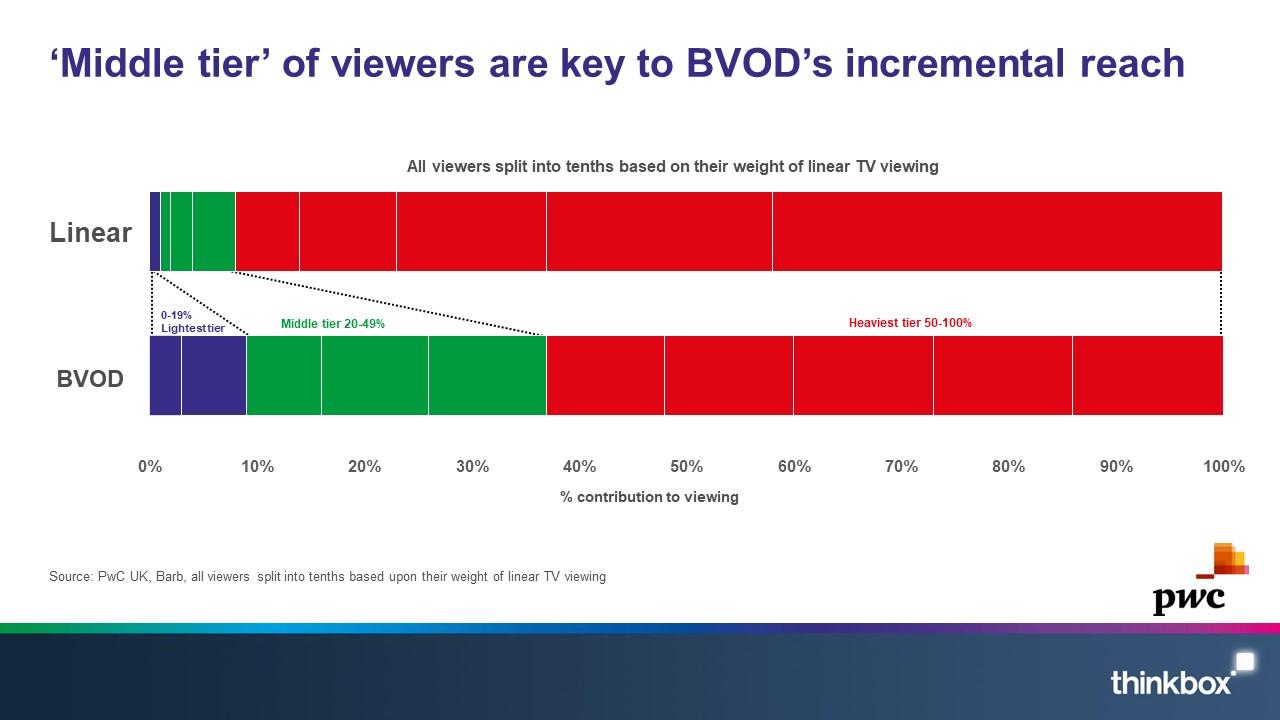

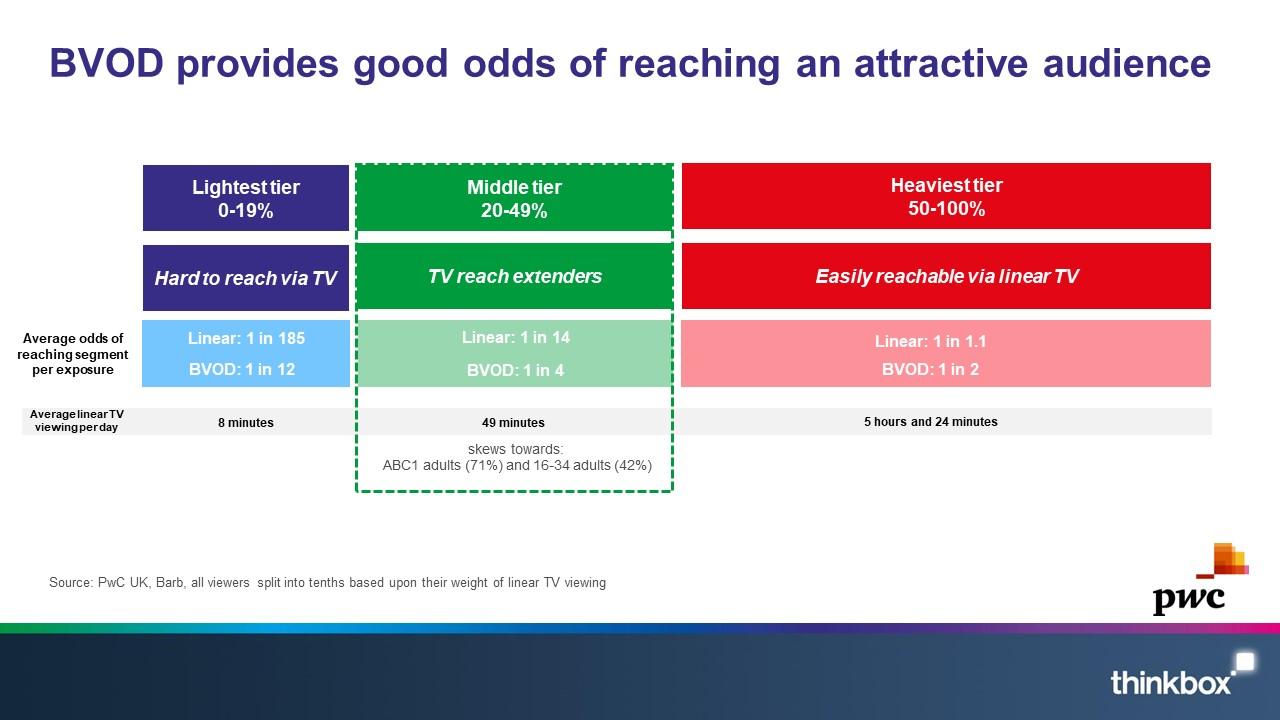

One of the main reasons for this incremental reach is the ease of reaching light linear TV viewers on BVOD – specifically the ‘middle tier’.

The middle tier is the 20-49% decile group in terms of linear TV viewing who also heavily over index on BVOD. They account for 7% of total linear TV viewing but 28% of BVOD consumption.

This group skews towards attractive audiences for advertisers - ABC1 Adults (71%) and 16-34s (42%).

Analysis shows that the chance of reaching somebody in this attractive group with a spot on linear TV is 1 in 14. However, when running a BVOD campaign, you are proportionately more likely to access the ‘middle tier’ with a 1 in 4 chance of reaching somebody in this segment.

BVOD planning insights

PwC identified five key BVOD planning tactics that lead to increased total TV reach. These are:

- Plan longer campaigns. The BVOD element of TV campaigns should run for longer than 30 days to optimise total TV reach. Campaigns that run for 30-50 days deliver 3 times the incremental reach of campaigns that run for under 30 days.

- Plan across all three TV sales houses. Light viewers are more likely to be found by spreading your plan across all sales points; using three sales houses delivers a 41% uplift in incremental reach of a single sales house.

- Plan in and around key programming, such as Love Island (ITV), Gogglebox (C4), or high-profile box set dramas like The Midwich Cuckoos (Sky).

- Plan across multiple genres. Campaigns delivered across 6-10 genres provide twice the incremental reach of those delivered across only 1-5 genres.

- Plan across a longer daypart. BVOD peak time is a longer window than linear (17.30-00.30 compared with linear’s 20.00-23.00).

In summary

- BVOD is a significant medium in its own right – and predicted to grow strongly.

- Driven by screen size, shared viewing and an appreciated value exchange, BVOD delivers advertising engagement.

- BVOD delivers good short-term and long-term ROI and improves total ROI by up to 10%.

- BVOD adds incremental campaign reach – driven by its ability to reach the valuable ‘middle tier’ of viewers.

Thinkbox

Thinkbox