Here we will show you the possibilities of using advanced TV advertising in practice and explore how different brands have been advancing their own use of TV by sharing some best-in-class examples.

Barclays – using advanced TV to reach lighter viewers

In 2019, the financial marketplace was evolving and becoming increasingly cluttered. The challenge for Barclays was how to maximise reach against their target audience of ABC1 adults.

OMD conducted analysis that showed that brand consideration is an important driver of sales and that weekly reach showed a direct correlation with consideration. They decided to target lighter TV viewers to unlock unique cover for Barclays and bolster their AV strategy, so they partnered with Sky Media and AdSmart from Sky.

Sky has a wealth of set top data regarding viewing habits, which includes a robust pool of the lightest TV viewers. Barclays became the pioneering test partner for AdSmart’s custom built light TV viewers segment running alongside the linear TV to build incremental reach against this hard-to-reach audience.

With access to Sky’s panel data, they built a bespoke tool to analyse potential programmes, channels, and times where they could reach light TV viewers. By using AdSmart in this way, they saw on average between 7 and 11% incremental reach for ABC1 adults.

As a result of this campaign, Barclays moved from 4th to 1st place in spontaneous consideration within their category. With brand consideration’s effect on business results, this was a huge result for Barclays and is a great example of how data can be used to make the most of any activity.

Soda Stream – using geo-targeting for precision targeting

SodaStream is an iconic brand with modern technology which substantially reduces single-use plastic bottles and offers a cheap source of sparkling water. In 2019, it was struggling to get significant high street distribution but pre-Christmas, an opportunity arose to test in 80 large Boots stores across the country.

The challenge was to shift units both instore and online to a level that would encourage Boots to reorder and to build awareness of the new positioning of the brand with a total budget of less than £400,000.

Pintarget analysed data that showed potential SodaStream users’ media of choice was a mix of TV and online. Their solution was to create 80 hyper-local TV campaigns to target high opportunity audiences close to specific stores using AdSmart from Sky technology.

The use of TV gave the brand stature, delivering a national weight branding campaign but only in areas where there was distribution of the product.

The objective was to communicate only to people who had the opportunity and intent to buy the product from Boots and Pintarget’s modelling work suggested this was potentially 650,000 homes out of a national population of 27 million homes. They were able to deliver a heavy weight campaign to a clearly defined target audience, defined by location and attitude.

The campaign created brand awareness and purchase intent that didn’t previously exist, helping an iconic brand to overdeliver on sales targets and secure valuable long-term distribution with Boots. SodaStream rediscovered its fizz and is now a committed TV advertiser.

Domino’s – embracing the world of advanced TV

Domino’s are the number one pizza delivery company and a committed, long-term TV advertiser, but they constantly must be alert with fierce competition from takeaway aggregators like Just Eat and Uber Eats.

Arena Media are continually evolving their AV strategy to stay ahead of the competition and recently moved from short sharp tactical campaigns to a more consistent year-round presence. For example, they sponsored the ITV Hub and All 4, which meant they reached 76% of their target audience every month.

In addition, Arena Media matched their own customer data with broadcaster data to segment specific customer groups. They then over-served these groups and as a result they improved the sales uplift 4.6 times.

As well as data matching, they did geo-targeting using AdSmart from Sky to run store-specific messages and campaigns that were relevant to the competitive threat in each area of the country.

They also re-targeted BVOD viewers with specific targeted deals and offers and built a non-exposed audience to maximise reach.

It is a great example of a brand embracing various advanced TV technologies and helped Domino’s to remain the nation’s favourite takeaway and delivery brand.

Hilton Hotels – using custom built audience to reach only the best prospects

Hotel chain Hilton wanted to raise awareness of their direct booking proposition. OMD’s aim was to educate audiences that booking directly on the Hilton website as opposed to using other online travel agents is simple and can save you time and money.

To be more precise with their targeting, they used Mosaic Groups. Mosaic is a consumer segmentation model designed by Experian. It is a classification system which segments the population into 15 groups and 66 types that helps you to understand an individual’s likely customer behaviour.

Through analysis, OMD found that the two Mosaic groups found to be most closely matched with Hilton prospects were the two named City Prosperity and Domestic Success. They combined these two groups to create a custom-built target audience.

The activity drove strong uplifts in spontaneous brand awareness with exposed groups 32% more likely to cite Hilton. Of those who recall seeing the advert, 27% took some form of action as a result, 17% visited the website and 4% went on to book a room via the Hilton.com website.

Sainsbury’s – using advanced TV to measure the effect of a campaign

Advanced TV technology can also be used to measure campaigns in in a different way.

ITV partnered with LiveRamp and Sainsbury’s to link campaign exposure data to in-store transactions. LiveRamp have a data connectivity platform that links disparate data sets enabling collaboration among different parties.

They compared two groups – one that had been exposed to the ad and one that had not – and then matched these to real Sainsbury’s customers to determine individual sales.

The exposed group was compared to a balanced unexposed group to determine the uplift in sales and increase in customers as a result of viewers seeing the campaign on ITV Hub.

An example of this in practice comes from a cleaning product (which we are unable to name for confidentiality reasons) who ran a 12-week video campaign on ITV Hub which reached 2.7 million unique viewers.

After six weeks, they ran the results. They found that there was an 8.3% customer uplift and a 10.6% sales uplift. The incremental sales amounted to £41,000 after 6 weeks but this rose to £207,000 after 34 weeks. The return on advertising investment was £1.23 after 34 weeks.

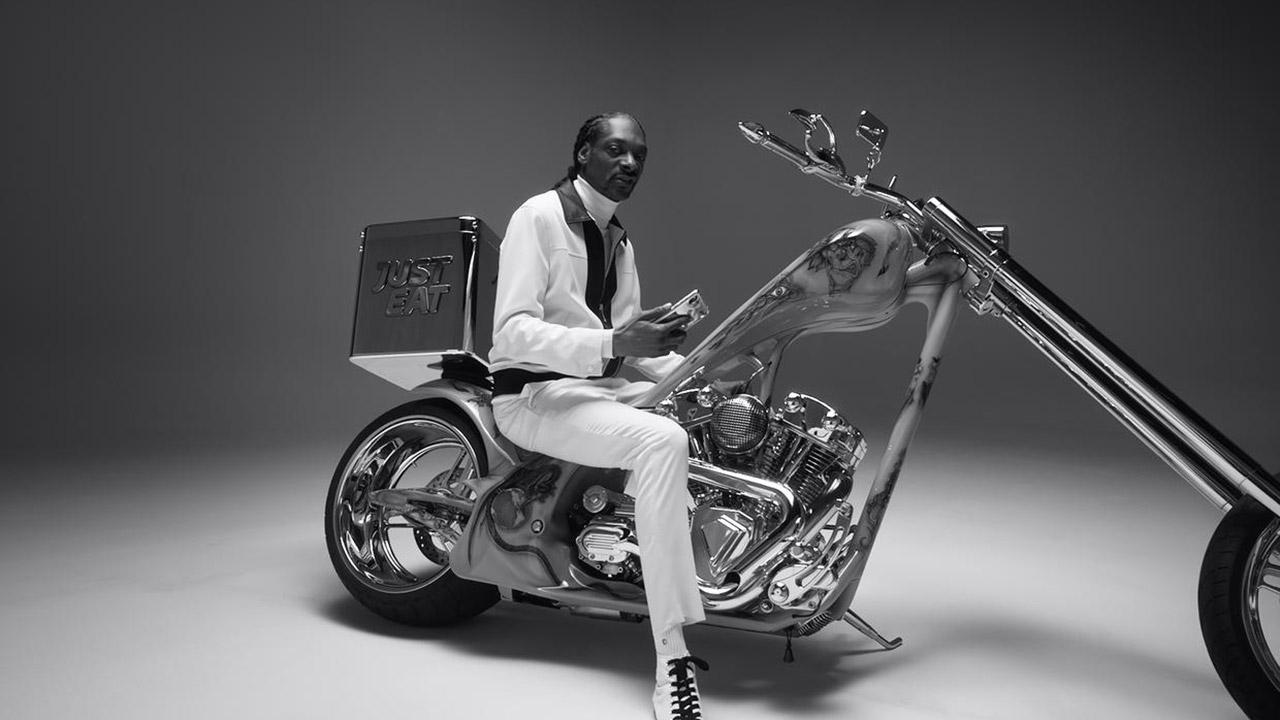

Just Eat - Matching their own data with Channel 4’s viewing data

Just Eat wanted to improve consideration and to increase purchase of takeaways.

UM decided that a good way to do this would be to target Just Eat’s lapsed customers. So, in 2020, Just Eat partnered with All 4 to trial their new advanced TV solution – Brandmatch.

The challenge was to activate Just Eat’s first-party data in a way that didn’t rely upon any cookie data and that was completely GDPR compliant. Working with data clean room Infosum and Channel 4’s advanced data management platform Mediarithmics, the Brandmatch solution allowed them to match users from Just Eat’s CRM database with Channel 4’s 24 million registered users.

This meant they were then able to target the highly valuable audience of lapsed Just Eat customers, delivering relevant advertising across all devices. This sophisticated targeting approach delivered great results, measured by independent research agency MTM:

- 63% uplift for spontaneous brand awareness among the Brandmatch audience.

- Significant increase in percentage of people claiming to order in the last month. *

- 38% uplift for consideration among the Brandmatch audience vs all 16–34s adults.

*Unable to share exact uplift due to confidentiality.

Thinkbox

Thinkbox