For most businesses, the cost of advertising is a very prominent consideration, and this is no different when it comes to TV. The below section covers how TV is traded, what impacts the overall price and some other considerations that will influence the cost of TV advertising.

The first and arguably most important thing to note is that, despite popular opinion, TV is not exclusively for the rich and famous or well established ‘big’ advertisers. Advertising on TV need not cost millions of pounds. In 2022, over 750 advertisers spent less than £50,000, almost 350 spent less than £10,000, and more than 200 spent less than £5,000.

Last year 959 new advertisers appeared on TV and the commercial broadcasters are extremely well placed to help in a variety of different ways:

The commercial broadcasters are extremely well placed to help new advertisers in a variety of different ways:

Not sure how to make a TV advert?

The broadcasters have specialist creative teams who can advise, assist or produce TV-ready adverts for various levels of investment.

Need help with the process?

All of the broadcasters have specialist teams dedicated to new advertisers, with or without a media agency, and they are more than happy to help guide you through the process.

Concerned about cost?

There are a number of ways the broadcasters can help to reduce the initial outlay including incentivised pricing, free airtime, shared reward schemes and more.

Speaking directly to one or more of the broadcasters can help kick start your TV journey. Contact details can be found here.

How is TV traded?

The currency on which TV is traded is called Cost Per Thousand (CPT). This is the cost of buying 1,000 impacts (note - not the same as reaching 1,000 individuals). These CPTs are variable, constantly changing and are usually represented in the form of a percentage discount off the station average price (SAP). The SAP is a benchmark price against which most buying and selling of TV advertising is calculated.

How do we arrive at the station average price (SAP)?

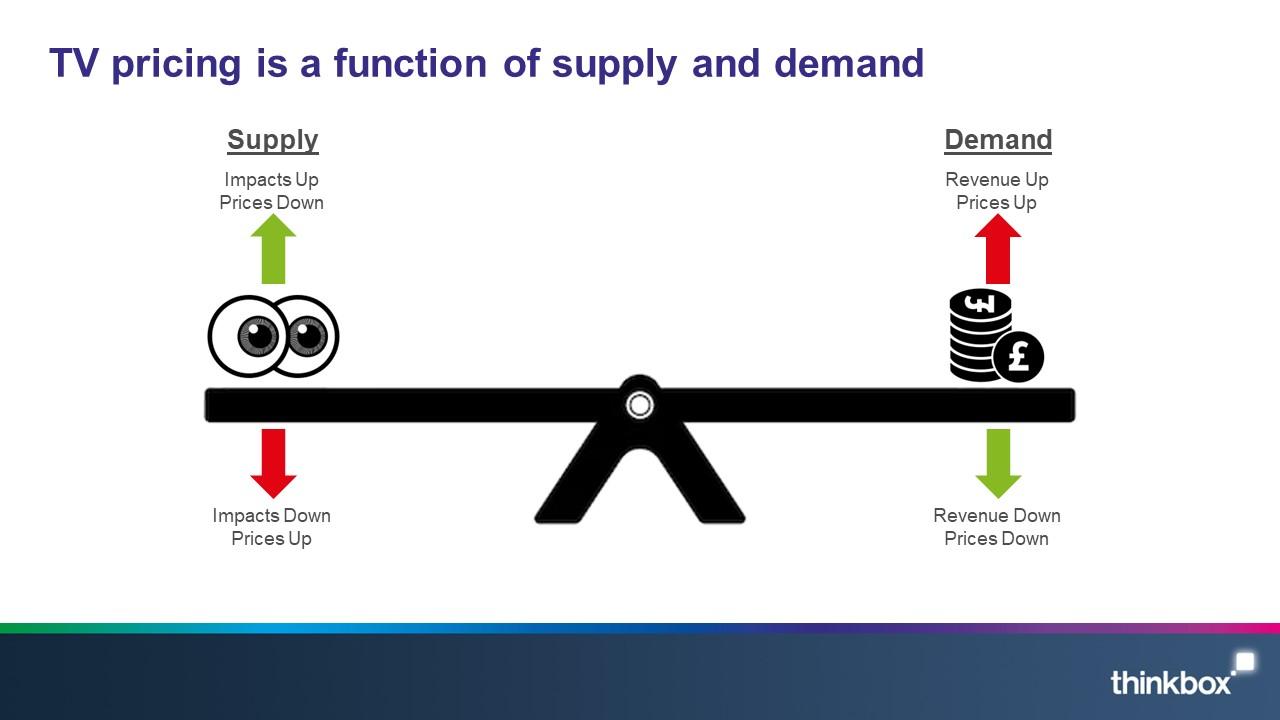

The SAP is a function of supply and demand. The supply in the case of TV advertising is represented by commercial impacts (the number of people watching TV on commercial TV stations) and the demand is represented by advertiser revenue. As you can see from the diagram below, the two sides of the equation work either together or against each other to push prices up or down.

Below are some examples of what can impact supply and demand:

The Economy – When we go into harder financial times, marketing budgets are often very early on the chopping block, impacting demand. The general public also has less money to spend, meaning they spend more time at home and crucially, more time watching TV, impacting supply.

Programming – The shows on TV can impact both supply and demand. Popular programming such as live sport will draw in both viewers and advertisers, impacting both supply and demand. The programming on non-commercial channels can also impact supply, as it can migrate viewers away from commercial viewing.

Weather – On the rare occasions that it is sunny here in the UK, audiences take the opportunity to get out and about, resulting in less time at home in front of the TV, impacting supply.

Audience – Different trading audiences have different SAPs attached to them. Supply and demand influences these prices depending on how much TV they watch and how desirable to advertisers they are.

Region – Different regions of the UK have different SAPs depending on the supply and demand within individual regions. For example, London is the most expensive region to advertise in as a result of low supply (longer commutes, longer working hours, etc.) and high demand (due to how attractive the audience is to advertisers).

Month – The cost of each individual month is again dictated by supply and demand. The cheapest month to advertise in is January - there is little advertising spend in the market and audiences spend more time at home due to the weather and increased spending over Christmas. Conversely, despite the high supply, September to November are the most expensive months to advertise as the increased pre-Christmas advertising demand outstrips the effect of the increased viewing.

Other cost influencers

Negotiated discount – The final CPT is based on a discount against SAP. This discount tends to be negotiated either annually or on a campaign basis, and is usually weighed against agreed levels of quality, access to premium programming, etc.

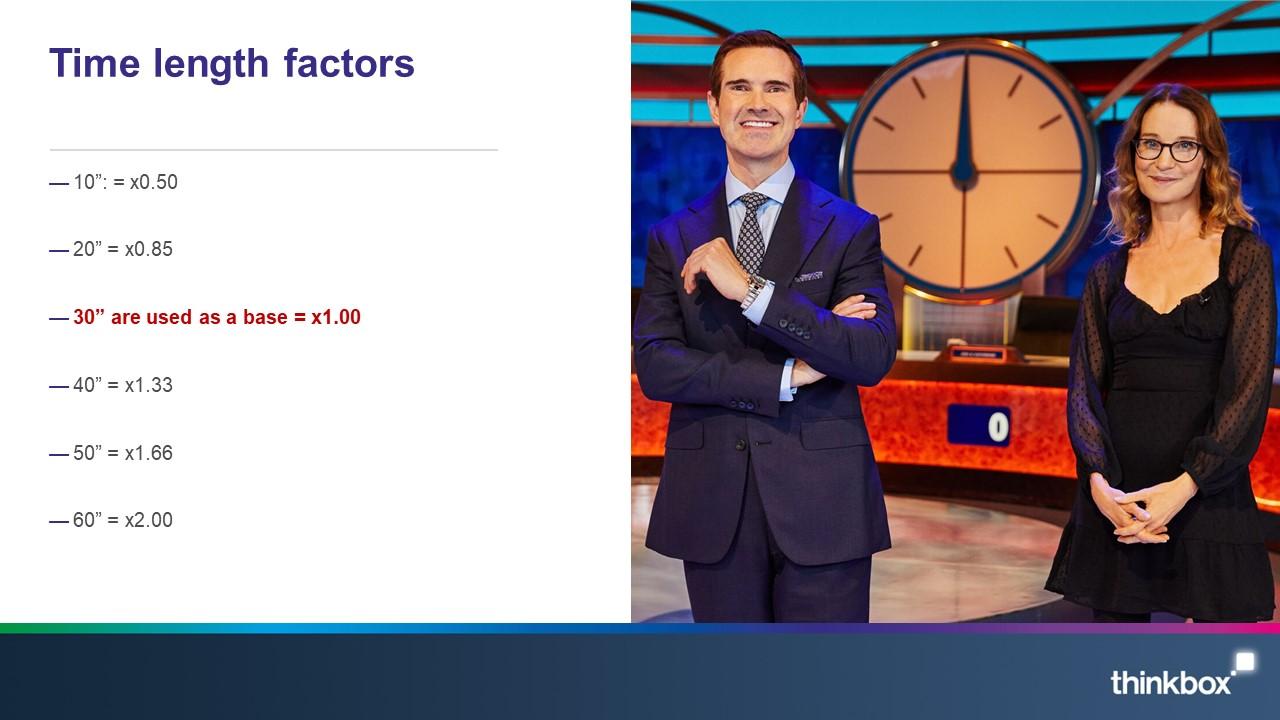

Length of Advert – Different lengths of adverts have different second length price factors attached to them. 30” adverts are the base we work from, so the factor is flat at 1.00. Any adverts longer than 30” have a second length factor proportionate to the extra time on screen e.g. 60” has a factor of 2.00 as it is twice as long as a 30”. For adverts that are shorter than a 30”, there is a slight premium charged as per the factors detailed below:

Thinkbox

Thinkbox