In Brief

Thinkbox has long been a champion of effectiveness – commissioning numerous award-winning studies that provide advertisers with the evidence they need to invest. Previously, this research tends to be based on bigger, more established brands. (This is down to the nature of the data; it tends to be bigger brands who invest in marketing evaluation.) Whilst these studies are hugely useful for many advertisers, they only show part of the picture. Are the same findings applicable to smaller brands?

The ‘As seen on TV’ study is different. This time the focus sits squarely on smaller advertisers looking for guidance on the most effective paths to profit and growth. How can TV supercharge small businesses? At what point should the move into TV be considered? How can TV be introduced when budgets are tight, and the stakes are high?

Key findings

- There are four main triggers that signal an advertiser is ready to move into TV: the point where existing campaigns fail to elicit the same effects for the same investment; the need to scale the business up and create a new demand pool; the ambition to build a brand and generate brand awareness; and the belief in AV advertising as a way of driving reach and building a connection with customers.

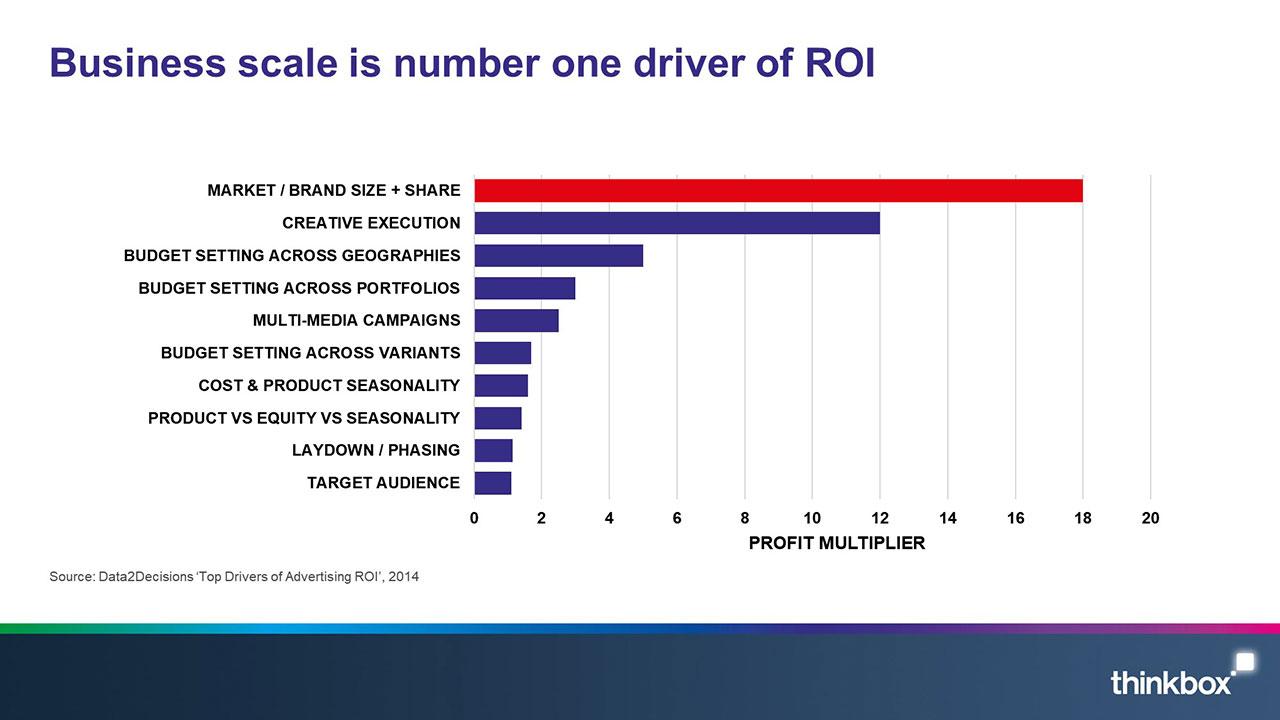

- Scale is the biggest driver of effectiveness. Small businesses should prioritise growth over profit – it’s the growth that drives the profit.

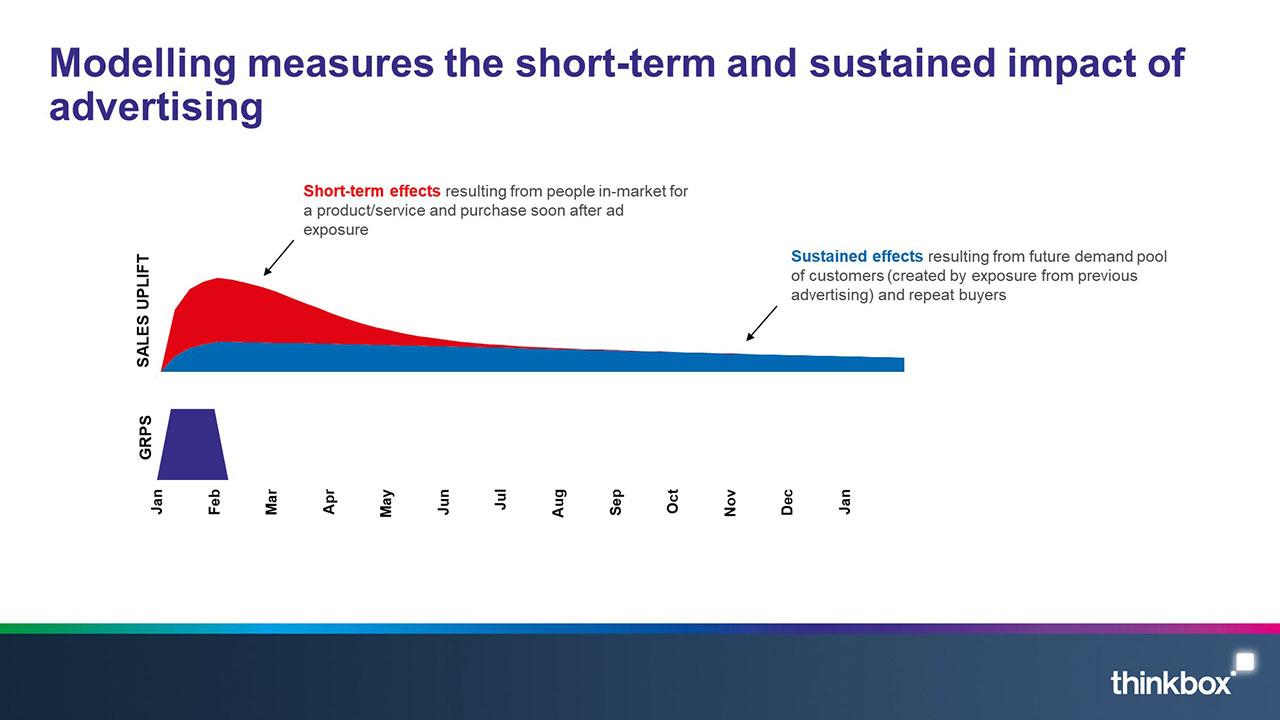

- Advertising has both a short-term and a sustained effect on sales. Advertising has an immediate effect on sales, but it will also work long after the campaign has ended through driving repeat business and resonating with customers who weren’t in market at the time of the campaign.

- The point of diminishing returns needs to be identified. Advertisers then need to invest in channels which stimulate new demand rather than those that harvest existing interest. TV drives growth quickly once other media channels have hit the point of saturation.

- Strategies that harness the benefits of TV but at lower cost can work well as a starting point. This can include advertising during cheaper seasons or dayparts or using shorter ads.

- Advertisers should start TV with a shorter, high impact burst strategy rather than a smaller, continuous drip approach. Building awareness is crucial to growth and makes activation campaigns work harder.

In depth

Methodology

This study consists of a two-pronged research approach:

Qualitative interviews with small advertisers, media agencies and broadcasters conducted by Work Research. This part of the study was designed to:

- Help advertisers identify at what point they should consider investing ad spend into demand-generating / brand-building media such as TV.

- Scope out the challenges and barriers that prevent progress to this next level of advertising.

- Provide advice on the right approach to TV.

Econometric analysis of 78 brands and 300+ campaigns for smaller advertisers conducted by Data2Decisions: This part of the study:

- Highlighted the principles smaller businesses need to consider when it comes to advertising effectiveness.

- Provided guidance on the relative roles of different media channels for driving growth.

- Offered advice on the best TV strategies.

- Provided benchmarks for the impact that TV advertising has on sales.

Part 1) Work Research

Methodology

Work were tasked with uncovering the barriers to TV advertising and following the journeys of advertisers who had recently made the leap.

They conducted 17 qualitative interviews with media and creative agencies who specialise in smaller businesses, broadcasters, advertisers who have made the leap into TV and tech specialists.

Work identified that there are four main triggers that signal small businesses need to move into TV advertising.

Life beyond performance Most small advertisers start their life within the world of online activation marketing - fishing from pools of customers who are already in market for their products. However, there comes a point when these pools stagnate and marketers must start to create demand as well as harvest it.

Quote: “Too many advertisers stay too long in the digital performance stage.” (Broadcaster)

Scaling up Once advertisers hit diminishing returns from activation channels (search / affiliate marketing / CRM) the time is right to test TV. TV is the best means of reaching new customers and generating demand.

Quote: You want the bigger volumes that are only possible with more reach.” (E-commerce sector advertiser)

Brand ambition

To achieve this next level of growth, advertisers must build their brands, creating memorable advertising that gives their business salience and an elevated position in the market.

Quote: “Driving growth from a different part of the market required a different media plan." (Property sector advertiser)

Belief in video Video advertising offers both a strategic advantage (generating a whole new pool of potential customers) and an emotional benefit (through increased storytelling, explanation and by heightening perceptions of quality).

Quote: “We wanted a catalyst for a long-term conversation to build relationships with donors.” (Charity sector advertiser)

Making the business case for TV

TV is often perceived to be inaccessible to smaller advertisers. Many small advertisers believe it’s too risky, unaccountable and too costly. But the experience of advertisers who have been there and done it suggests that these perceptions are unfounded.

Effects are visible, tangible & quick Effects are visible through analysis of web traffic and PPC (pay per click) performance will see big benefits when TV is used.

Quote: “We were astounded at the site-traffic we got – a phenomenal spike.” (E-commerce sector advertiser)

Advertisers need a new measurement framework for TV Testing is essential to learn which variables do and don’t work and which attribution tools can help optimise performance.

Quote: We’re seeing halo effects on our search performance.” (Travel sector advertiser)

TV is cheaper than originally thought Production of creative can be achieved for £3-5k and campaigns that deliver the required cost per acquisition can be bought for tens of thousands, rather than hundreds of thousands, of pounds.

Quote: “You can test on a tight budget and get a huge amount of learning about which variables do and don’t work.” (E-commerce sector advertiser)

How to get TV right

Box clever Use the flexibility of TV to achieve goals by harnessing certain times of day, channels, spot lengths or even advanced data-driven solutions. Choose the right agency to work with, as they know the world of TV inside out.

Quote: ‘A good agency will show you all the clever moves.” (E-commerce sector advertiser)

Measure for brand effects, not just performance TV drives future growth which needs to be assessed through brand tracking.

Quote: “Last year was all about DRTV but the big shift for us in the past six months has been driving brand.” (E-commerce sector advertiser)

Engage the whole business TV has a positive, palpable effect on staff, stores and suppliers. PR the use of TV to motivate all stakeholders.

Quote: “We see a 10-15% uplift in performance which we can attribute to the staff being motivated when they’re seeing the ad on TV.’ (Services sector advertiser)

Part 2) Data2Decisions

D2D used their extensive list of smaller advertisers and brands (the smallest 10% of their dataset) to uncover the impact of TV and the most effective TV strategies for advertisers who had made the move to TV within recent years.

The foundation principles of effectiveness for smaller businesses

Scale is the biggest driver of effectiveness The bigger you are as a brand, both in terms of your physical availability (distribution / number of stores etc.) and your mental availability (the top of mind awareness of your brand / number of positive brand associations you have in the minds of your consumers), the harder advertising works for you. The unit cost of advertising is pretty much the same if you are a big brand or a small brand, but a bigger brand has a higher chance of driving effectiveness than a small brand. One million people seeing an ad for Tesco will convert more sales than one million people seeing an ad for Waitrose.

The upshot of this is that smaller businesses need to focus on growth over profit. The bigger and more famous you become, the harder your advertising will work for you.

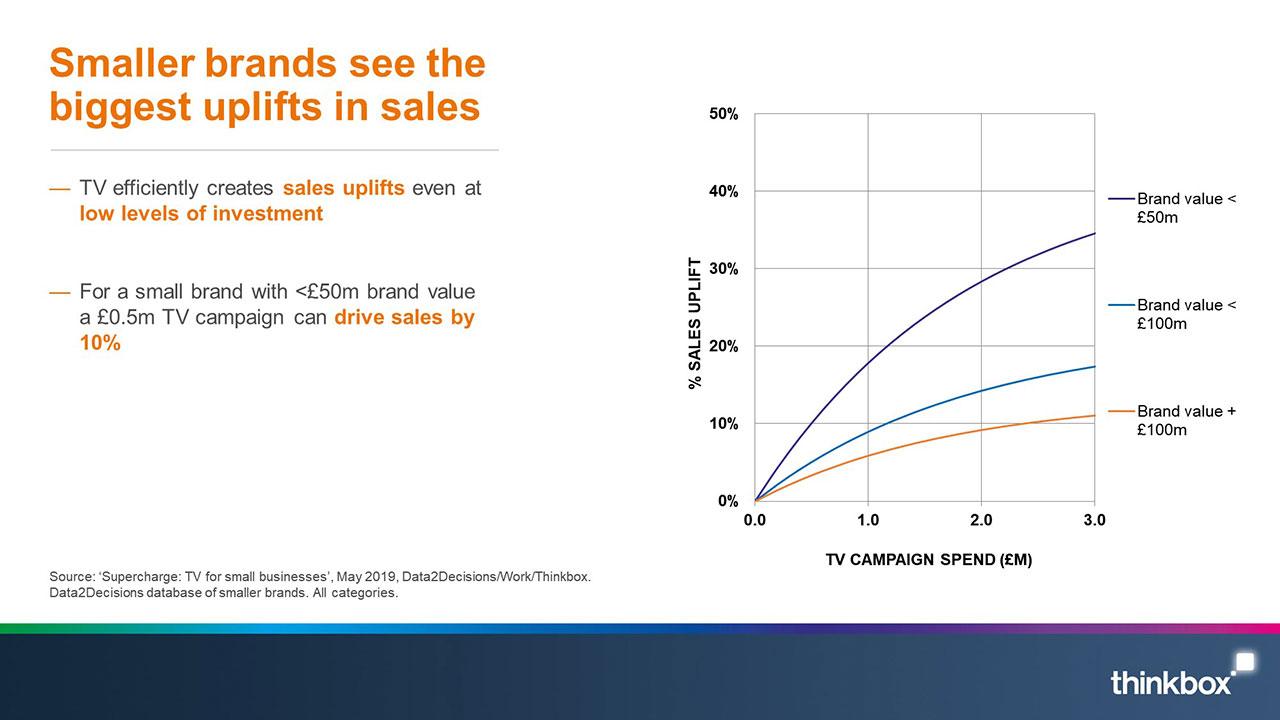

One advantage that smaller advertisers have over larger ones is that advertising-driven growth is a lot easier to achieve. Smaller businesses are starting from a low base so there is a huge untapped market of non-buyers that can be converted to buyers through advertising.

Advertising has both a short-term and sustained effect on sales Advertising will have an immediate effect on sales throughout the period of the campaign and for a short period after (circa 3 months). However, sales effects will continue long after this as it drives repeat purchases and resonates with customers who weren’t in market at the time of the campaign, but came into market later.

These sustained advertising effects are the key to growing ‘base level sales’ i.e. the sales a business creates without any marketing activity. Base level sales / sustained advertising effects are the biggest overall contributor to advertising-driven profit.

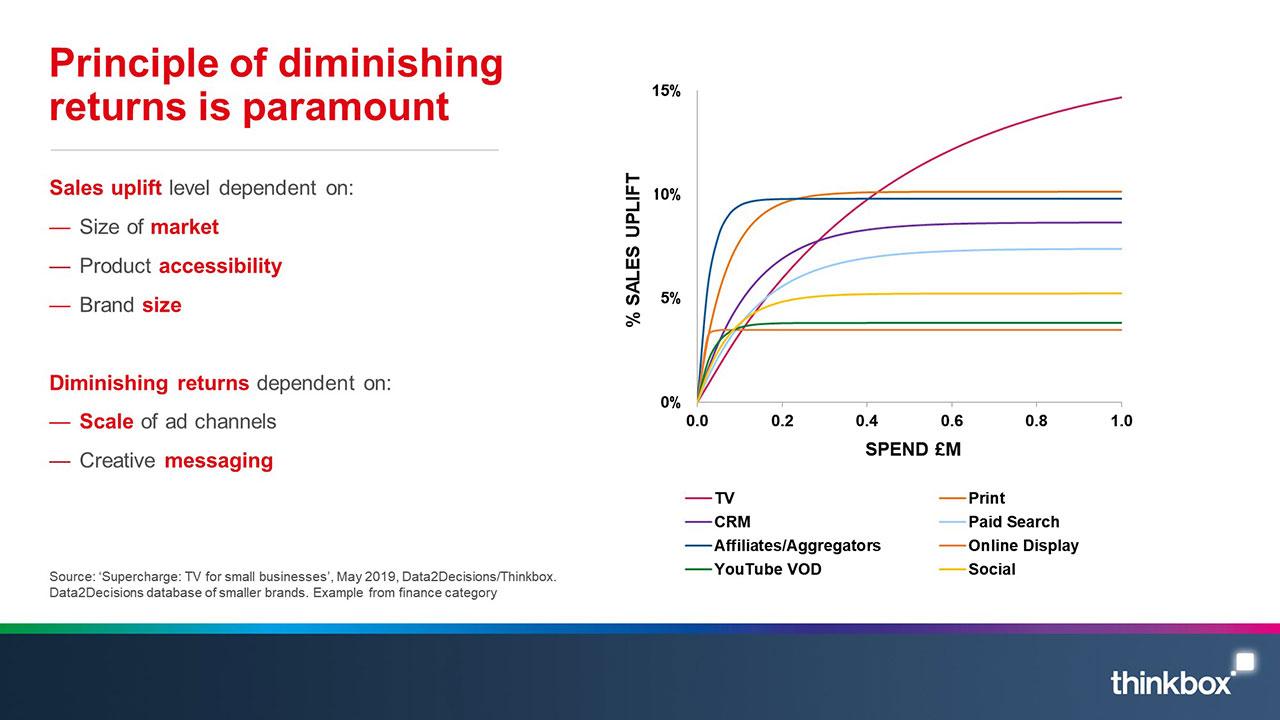

The principle of diminishing returns Different advertising channels produce differing levels of sales at different volumes of advertising investment.

Some channels are efficient at low levels of spend, but quickly become inefficient as investment increases. This is typically true of channels which harvest existing market demand such as search or affiliate marketing, where advertisers are fishing from a pool of customers who are actively looking for their product. Once this pool has been drained, spending more on these channels becomes inefficient as it speaks to the same people repeatedly and fails to convert new customers.

Advertisers therefore need to use channels which generate demand (such as TV, print and radio) which can be less efficient at lower levels of spend, but continue to drive sales growth at higher levels of investment. This is because they reach high numbers of people and numerous research studies show that this is the key to unlocking growth.

The point advertisers hit diminishing returns depends upon several variables:

- The brand (product accessibility/distribution, size of target audience, size of brand in terms of ‘mental availability’).

- The channels used to drive reach versus the size of the product audience/userbase.

- How effective the ad exposure is, both in terms of creative execution and the quality of that exposure.

Facebook has high reach, but hits diminishing returns at low levels of spend as the ads are easily avoidable. Niche channels which have low reach, but are highly effective, tend to be very efficient at lower levels of investment, but hit diminishing returns quickly. For example, fashion magazines are great at low levels of spend for fashion retailers as they hit a highly targeted market with impactful ads, but diminishing returns kick in as the audience for fashion magazines is limited.

For small advertisers, the media challenge comes down to evaluating the most effective route for growth through the optimal combination of channels. By prioritising immediate profit over growth, it’s likely that there’ll be a good return on investment, but it will be difficult to increase sales beyond a certain threshold.

At what point should TV be considered? Businesses are ready to consider TV at the point they hit diminishing returns on the channels that offer the most efficient and obvious route to growth. These channels will differ depending on the type of business. For financial services, they’ll likely be search, affiliate marketing or direct mail. For retail, print (niche magazines), social media and search tend to take priority and for FMCG it will likely be that TV is the optimal starting point.

Once increased ad spend stops converting into sales, the point of diminishing returns has been hit. This is when advertisers need to consider moving money into channels that provide more capacity for growth.

This is not to say that spend should be cut entirely in the original channels, just that spend should be capped to the optimal weekly levels and budget made available for investment in the next most efficient channel for the category.

The chart above is a financial services example which shows the average diminishing returns curves for all media channels within D2D’s database of small advertisers. TV clearly has the highest capacity for growth, whilst offering an efficient return at low levels of weekly spend.

This is because TV has huge scale and is a highly effective means of quickly getting your ad message in front of your target audience.

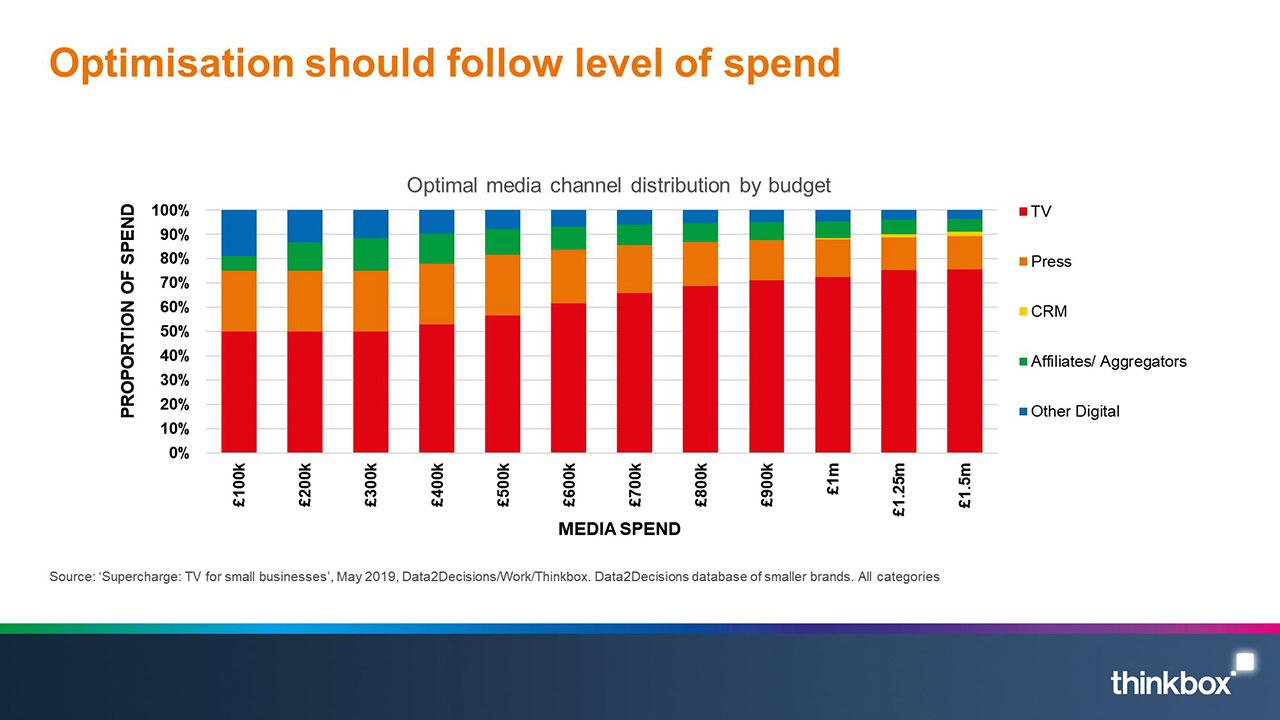

Using this data across all categories, the optimal split of media based on these diminishing returns curves is illustrated below.

At low budgets of circa £100k, TV should take around a 50% share. As the business grows and ad spend grows, the share that TV takes should increase as TV has the highest capacity to drive growth before diminishing returns kick in.

What’s the best way to use TV?

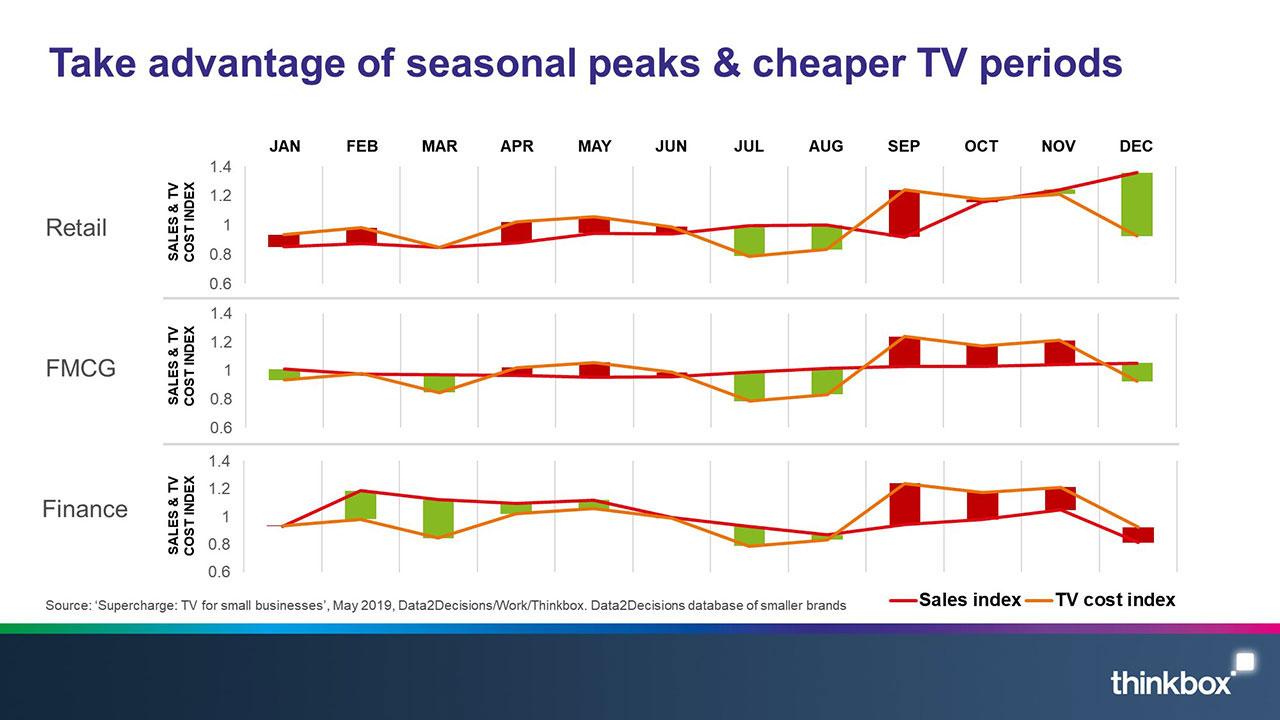

When’s the best time to advertise? The price of TV advertising is not constant and fluctuates throughout the year, therefore different categories should harness different windows of opportunity where TV is priced favourably and sales are likely to be higher. For example, for FMCG the optimal months are July and August, for retail it’s December and for finance it’s February and March.

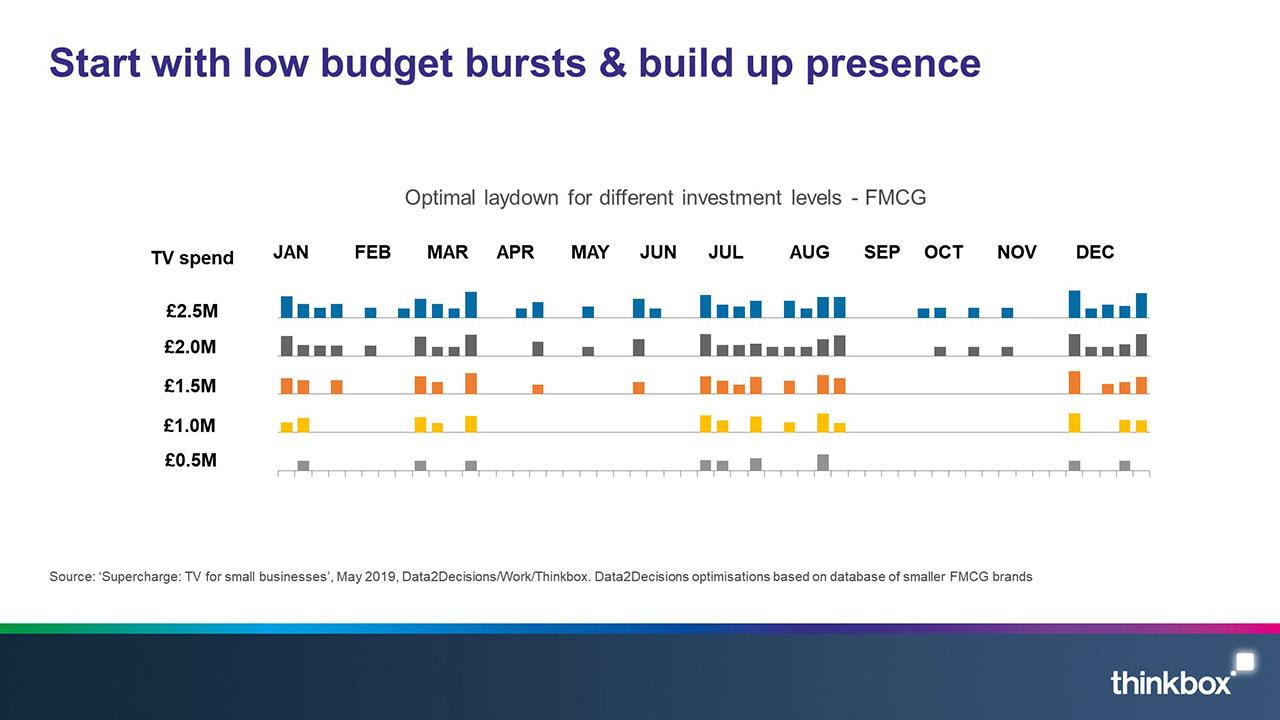

Should TV be used for impact or consistency? Advertisers should start TV with a high impact, ‘burst’ strategy rather than a smaller, continuous ‘drip’ approach.

On a limited budget, it’s better to make the biggest impact possible across a few weeks, rather than spreading budget out over a longer period of time. This is because TV’s diminishing returns ceiling is high. Unless you’re spending over £300k in a week you’re not going to hit that ceiling and there will always be new people to watch your ad. The best strategy, therefore, is to max your opportunity at the optimum time based on the seasonality of your business and the seasonal pricing of the TV market.

As businesses grow, they should then move on to have a more continued TV presence across the year, prioritising the next most efficient periods, as shown in the example of an FMCG advertiser, below.

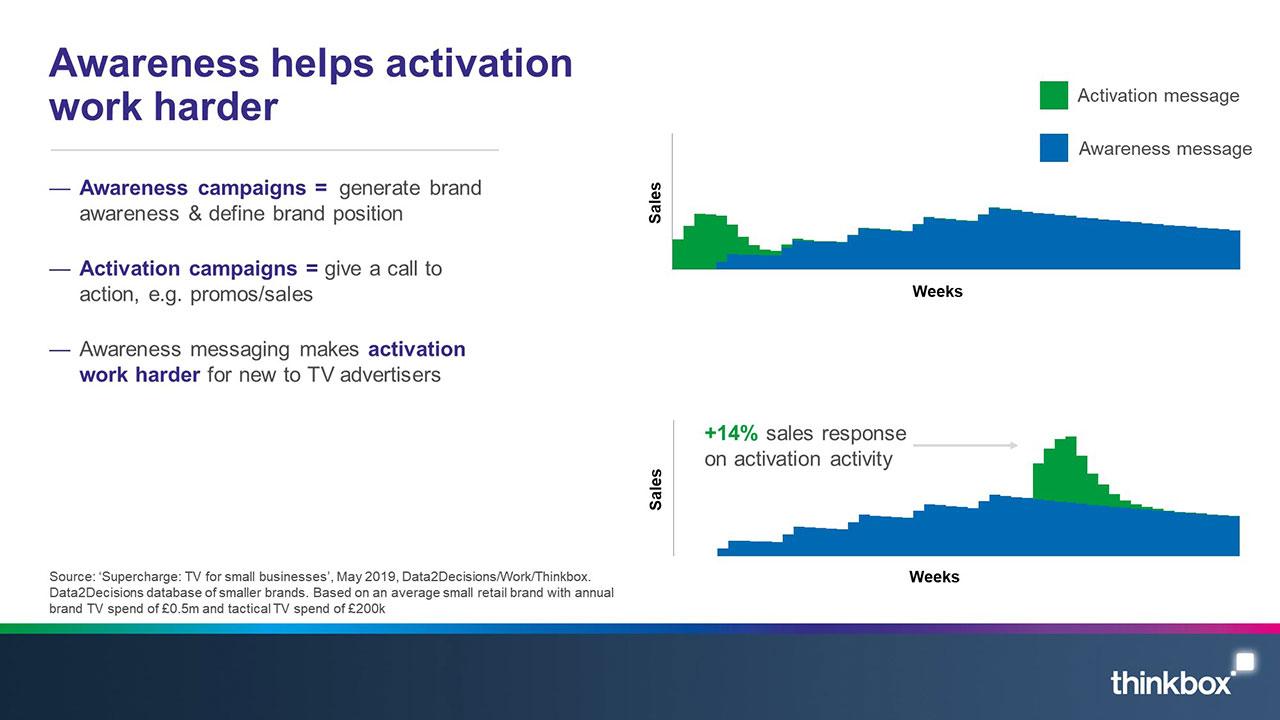

Should TV creative focus on activation or awareness? The primary role of TV should be to drive brand awareness. This doesn’t mean that it shouldn’t also deliver a call to action, but for newer or smaller advertisers, the focus should always be getting the brand out there and making it known.

Once a brand becomes familiar to people, activation messages that deliver a call to action or highlight offers or promotions, become more effective too. The research found that there’s +14% increase in effectiveness if activation messages follow branding campaigns. The benefits don’t stop there. Non-TV activation channels (such as search/affiliates/DM etc) will also see an increase as brands becomes more familiar and people feel more confident in purchasing them.

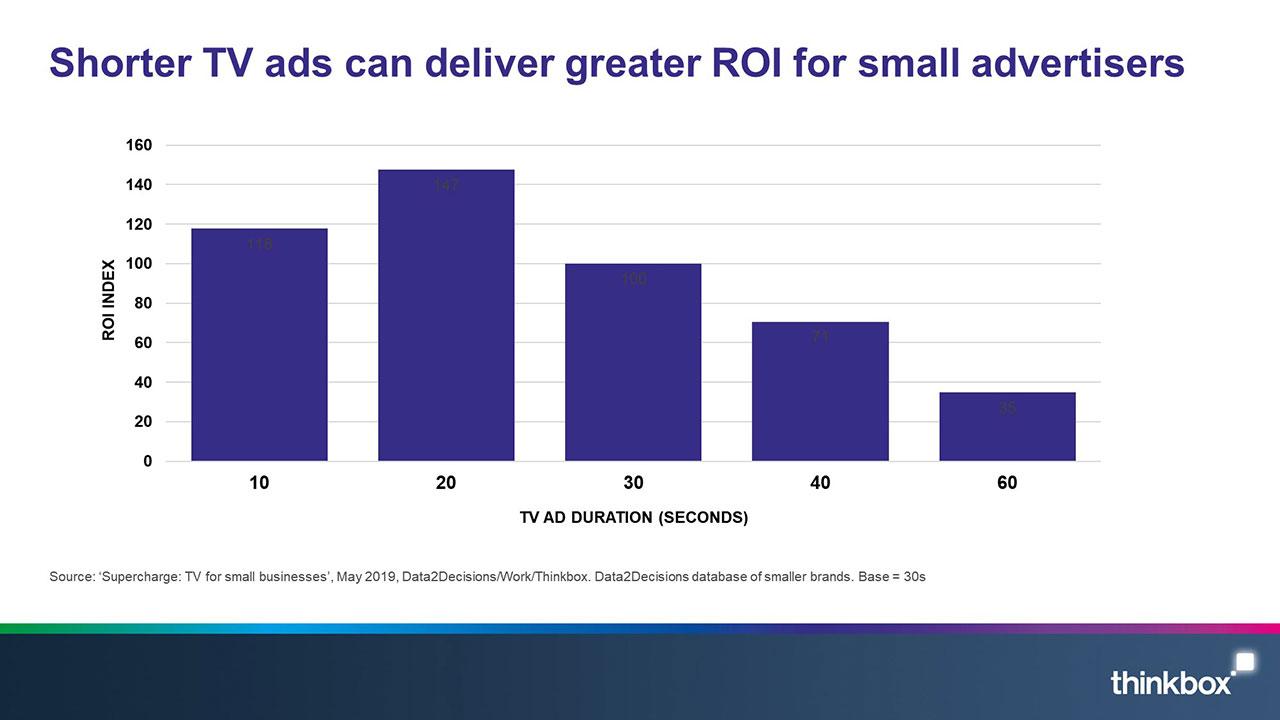

How long should a TV ad be? The simple answer to this question is, ‘no longer than it needs to be’. The reality is that much depends on what needs to be communicated and the complexity of the message.

Shorter ads allow greater exposure for a given budget (10 second ads are half the cost of a 30 second ad), but it’s very difficult to create a memorable, awareness-driving ad in 10 seconds or under (see ‘A Matter of Time’ study).

Based on the D2D database of smaller advertisers, 20 second ads proved to be the most efficient and probably the best starting point, as long as there isn’t a complicated message to convey.

What can TV be expected to deliver?

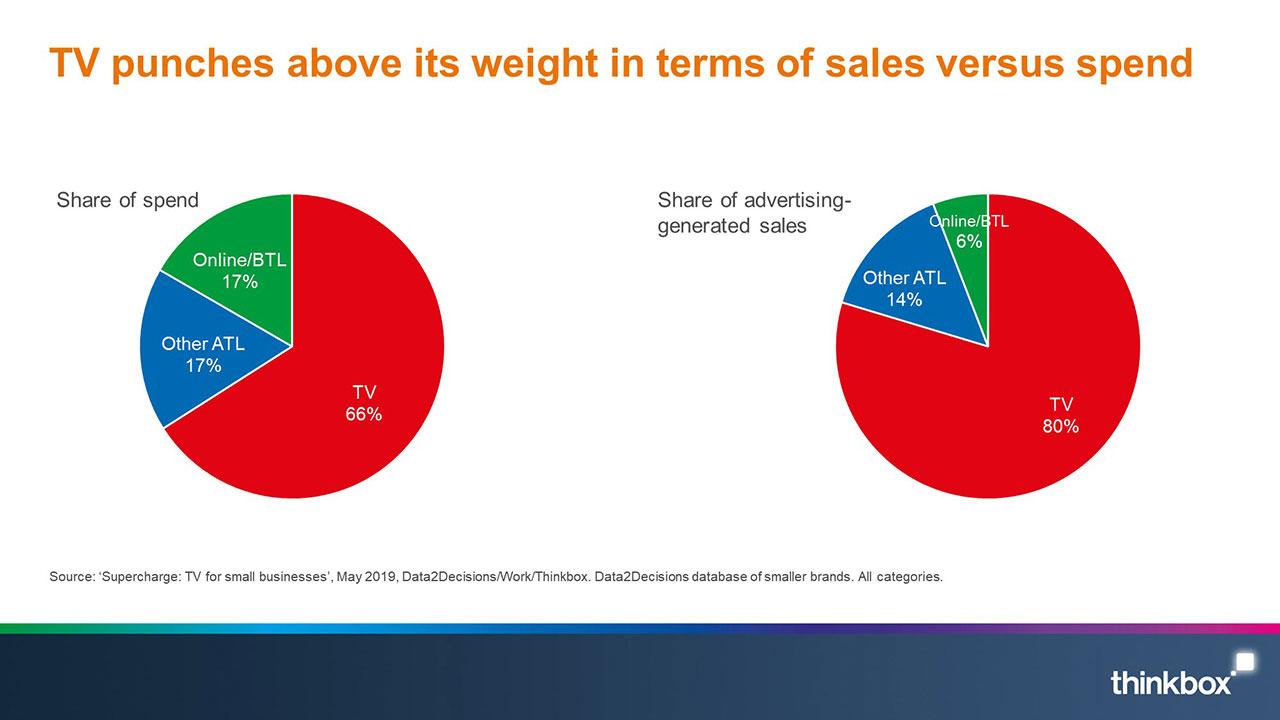

Advertisers can be confident that TV will be a powerful driver of business growth. Out of the D2D dataset of 78 brands, TV constituted on average 66% of their media budget, but returned 80% of all ad-generated sales. This means TV was the most important driver of growth.

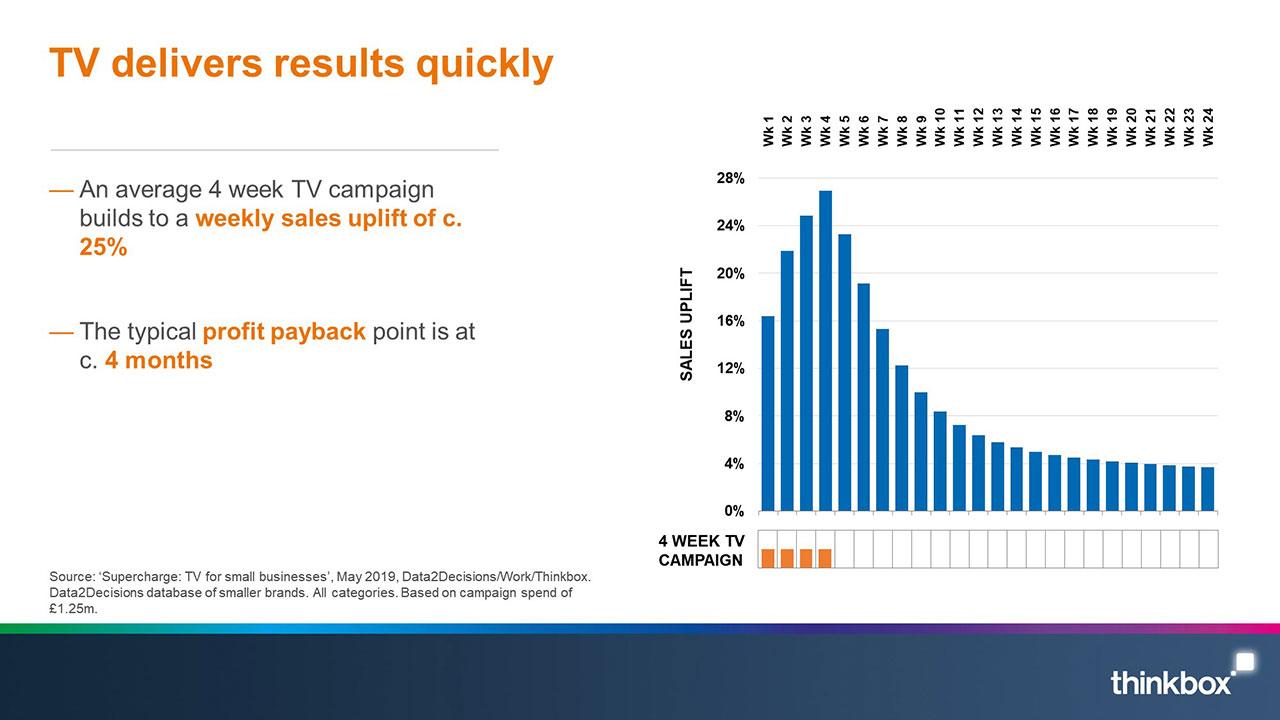

How long does it take for TV to pay back? In terms of delivering payback on investment, the average TV campaign will deliver a revenue return two weeks after the campaign for retail, five weeks after for finance and seven weeks after for FMCG.

The chart below shows the average uplift against base sales (the average number of sales generated by your businesses without any advertising or promotional activity) for a four week TV campaign with a budget of £1.25m. Throughout the four weeks while the campaign is on air there is a continued uplift in the volume of sales versus the base level as brand awareness grows. Once the campaign finishes this effect decays fairly steeply over the following 5-6 weeks. However, the effect doesn’t decay completely, with uplifts continuing long into the future from repeat purchasing and residual effects of increased brand awareness. Based on the average campaign, a typical profit payback point is around four months post-campaign.

As aforementioned, it takes longer for smaller businesses to achieve a profitable payback on advertising investment than larger business due to their lower levels of physical and mental availability. However, on the flip side, it’s much easier for smaller businesses to drive uplift in growth over the base. The smaller you are, the more room you have to grow, so growth should be the primary goal (not ROI) and the key KPIs should be lead indicators of growth – web traffic, footfall, sales, increased brand awareness.

How does this differ by category? Quite a lot. The key influencing factor is once again business size and/or brand size. FMCG products generate small margins relative to a retailer, for example. (Think about the impact of one ad influencing the sale of a) one bottle of fabric conditioner, versus b) an entire weekly supermarket shop.)

Bigger businesses have greater opportunity to benefit from advertising. In order to become a bigger business and sustain market position, these advertisers have much largerer operating costs. However, including these costs in the evaluation of media (i.e. basing ROI on net profit rather than gross profit) becomes a futile exercise. Once a business has developed to the point where advertising becomes a necessity to growth, it should be assessed on the basis of how much incremental profit it generates. Or, indeed, how much growth it delivers relative to the direct ad investment required.

This way, the role of advertising can be directly compared against other potential investments the business makes.

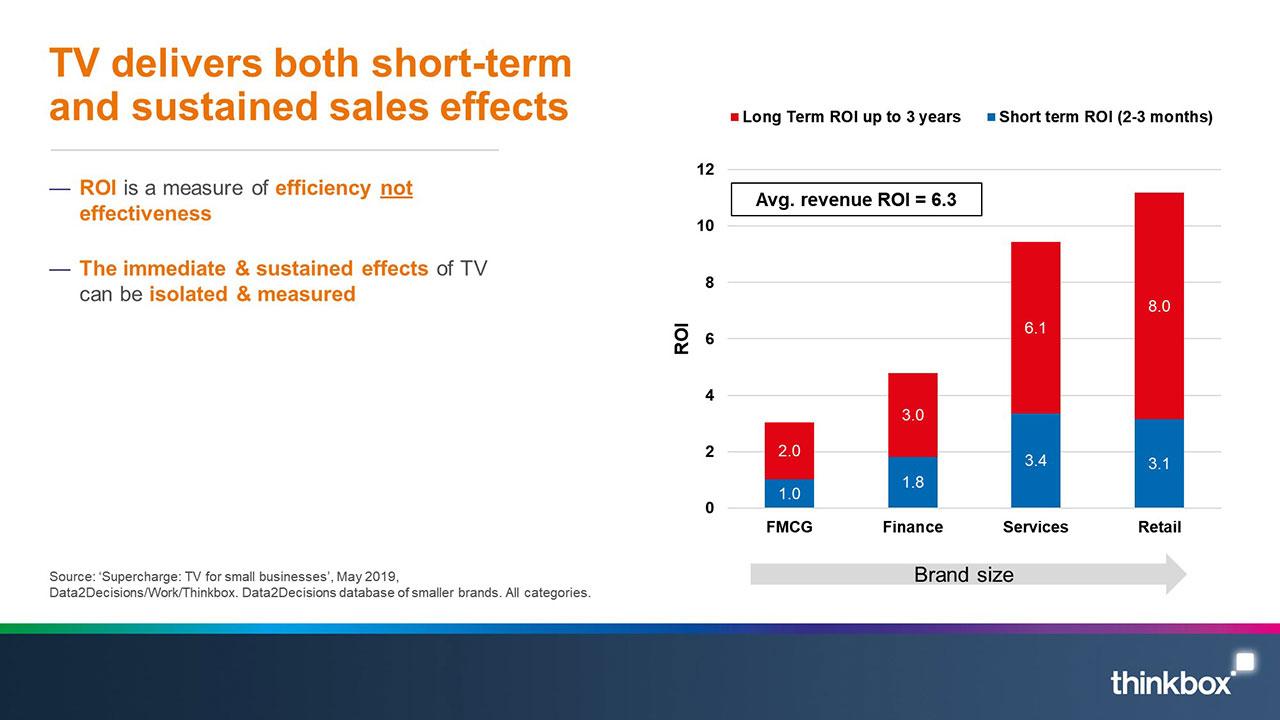

The chart below shows how different categories compare for short-term and sustained ROI effects.

Recommendations for smaller advertisers

- Recognise the signals in the numbers. Work with your media agency to create your own diminishing returns curves and determine if your business is maxing out, or even overspending, on your existing marketing channels. If you are hitting diminishing returns, it’s time to consider moving into media which generate new demand, such as TV.

- Adopt a growth mindset. Moving to the next phase of advertising-driven growth requires a better understanding of how advertising works. Get familiar with the most celebrated and respected work in this area, such as “How Brands Grow” by Byron Sharp and ‘The Long and Short of It’ by Les Binet and Peter Field. These are both essential reading.

- Position and proposition. As you move beyond the demand-harvesting channels, it’s vital to have a clear proposition and position within your market. If you have this already, move forwards. If not, ensure that you understand where you sit within your potential market, what makes you distinctive and what it is that you want to communicate within your messaging before you progress.

- There are deals to be done. Step into the market place to see what offers are on the table. Explore your options with media agencies, creative agencies and media owners. There are always deals to be done for new advertisers and plenty of support.

- Dive into the detail. Use the insight available to you to plan your campaign. Factor in seasonality, time of day, day of week, target audience, content, context and anything else you can think of. These are the dials that optimise your plan – make sure you use them.

- Prepare for fast effects. The impact from TV can be immediate and direct. Make sure your servers are ready for an increased volume of web traffic and that you have the means to physically deliver the extra orders you take. Make sure you have a measurement framework in place prior to your campaign, be it measuring attribution or awareness. Be clear on what you’re trying to achieve and how you’re going to measure it.

- Test and learn. Nobody can predict the effect of going onto TV for the first time. Use attribution software to help you learn what variables trigger your brand responses and use this to adjust your campaign. However, be careful not to become too focussed on the minutiae at the expense of the bigger picture. Look at the consistencies in variables that trigger a response as opposed to chasing a narrow set of parameters.

Thinkbox

Thinkbox