In Brief

It’s been a decade since Thinkbox’s first ‘Ad Nation’, a landmark study exploring the differences in media consumption and perception between the average person in the UK and those who work in media.

Back then – and again in an update in 2016 – the study discovered a chasm between the media consumption habits of the UK public and media professionals. Recent years have also seen major changes in the way we consume content, such as the impact of Covid-19 and the changing video landscape with the rise in streaming services and emerging social platforms leading the way. It is hard to deny that the world has shifted dramatically since our last update but has this had an impact on the way the two groups consume media.

Our refreshed study, ‘Adnormal Behaviour’ explores the differences between the general public (’normal’ people) and ad industry professionals as it examines claimed attitudinal and behavioural data on TV content and viewership, device/platform usage, and perceptions of advertising. It also explores the accuracy of adland’s ability to correctly predict the behaviour and consumption of ‘normal’ people.

Methodology

The study is based on a random probability survey by Ipsos of 1,158 people weighted to be representative of the national population, and a survey of 216 media professionals, it examines claimed attitudinal and behavioural data on TV and other media types.

Key points

- The pandemic has not impacted media behaviour as much as the industry believes

- Both ‘normal’ people and ad people underestimate the proportion of live TV viewing that occurs

- Ad people have a good feel for the penetration of platforms but overestimate for the new emerging platforms

- Both groups acknowledge TV as the most trusted, most emotional and most memorable form of advertising

In Depth:

Background

Differences between the ad industry and the public is an ongoing topic of conversation. Understanding your audience is the golden rule in marketing and ensuring that their behaviour is accurately reflected is key. As an industry, we are generally leading the charge for new and emerging platforms but how does this compare with the British public.Our previous study ‘TV and Ad Nation’ delved into this popular topic and explored the differences in media consumption and perception between those who work in media and the average person in the UK. Similarly, there have been a number of other ad industry studies, including Newsworks’ ‘Sample of one’ and Reach Solutions ‘The Empathy Delusion.’ Much like our project, these studies sought to have a positive impact on media professional’s ability to better estimate the media consumption patterns of the UK.

Since our last landmark study in 2016, there has been a wealth of change that has made this study more important than ever. The landscape is constantly changing, accelerated by the rise of subscription streaming services. Services such as Netflix, Amazon Prime and Disney Plus have marked out a place in people’s home and have evolved the way in which people consume TV content. The proliferation and variety of platforms have changed the online video landscape, with a surge of short-form video social platforms such as TikTok. Advertising expenditure has also evolved, with strong growth in expenditure and the rise of certain sectors such as online born businesses. And lastly, and arguably the largest shift in behaviour is the pandemic, the impact of Covid-19 has been a considerable influence in changing media consumption patterns.

Considering the variety of ways media consumption has evolved in recent years, we felt it was right to recommission Ipsos to conduct this project and see whether the chasm between the media consumption habits of the British public and media professionals has changed, whether the way in which we consume TV content has evolved and what impact the Covid pandemic has had on media habits.

Methodology

Ipsos conducted the analysis which consisted of two samples. The British public – aka ‘normal’ people was based on a random probability survey by Ipsos of 1,158 people weighted to be representative of the national population, and a survey of 216 media professionals (ad people). It examined claimed attitudinal and behavioural data on TV content and viewership, device/platform usage, and perceptions of advertising. Whilst both samples were asked the same set of questions, ad people were also asked about the way they thought the British public consumed media content. The survey also touched on the evolution of content consumption compared to pre-pandemic.

Unsurprisingly given the occupation of the samples, the two groups have a demographic disparity, specifically in location and age. Ad people were more London-centric than ‘normal’ people and were much younger in comparison to the larger nationally representative sample.

Findings

1. The pandemic has not impacted media behaviour as much as the industry believes

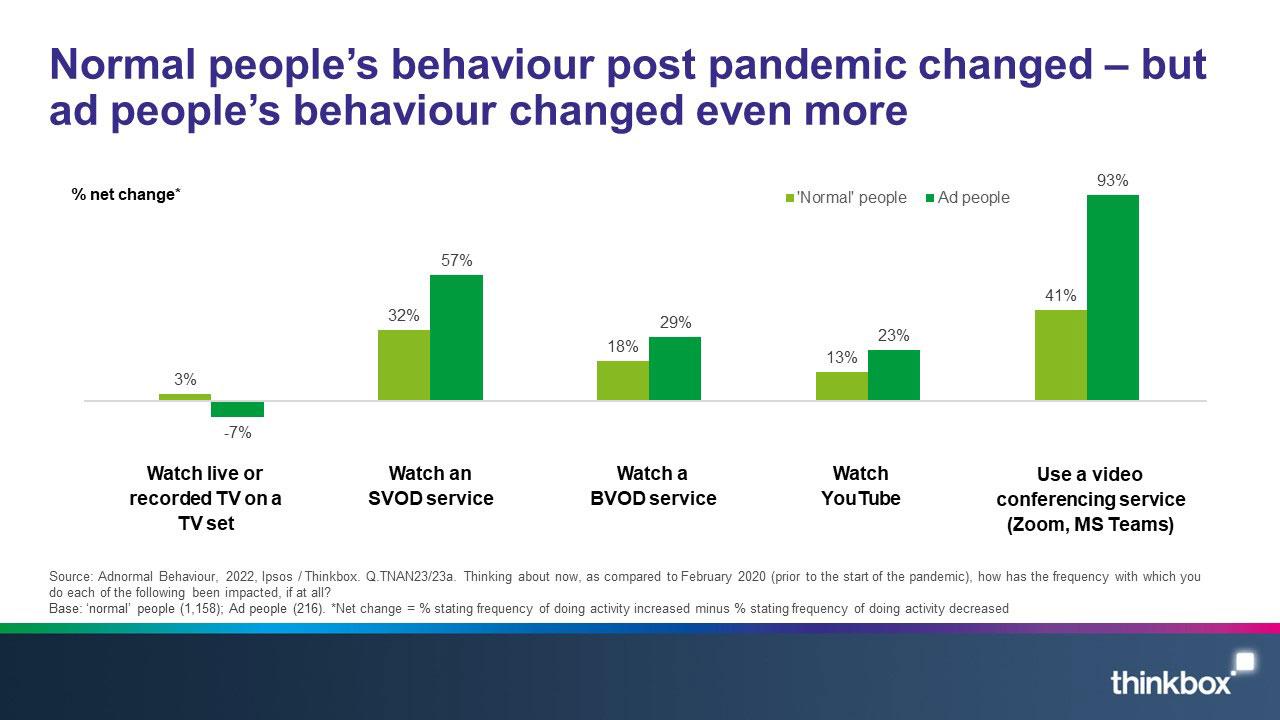

March 2020 saw the start of the pandemic and brought about major behavioural change. To understand more about the Covid effect, the survey probed respondents to think about whether the frequency with which they did particular activities had been impacted in any way (so whether it increased, decreased or stayed the same).

Specifically focusing on the consumption of video-based content and looking at the net change for each activity (subtracting the percentage of people that stated that they decreased the frequency of doing that particular activity from the percentage that stated that their frequency had increased), data shows that ‘normal’ people saw an increase in change across the board. However, ad people saw significantly greater change.

Whilst watching live or recorded TV on a TV set decreased, the consumption of other video-based platforms such as watching a subscription service (SVOD), consuming Broadcaster VOD (BVOD) and watching YouTube had increased, and at a higher rate than ‘normal’ people. Unsurprisingly, the largest change was seen in using a video-conferencing service, with 93% of ad industry respondents stating that they increased their use of Zoom and Microsoft Teams.

Whilst ad people saw a larger shift in their consumption habits, it is clear that the British public did not mimic the same behaviour to such a significant effect.

2. Both ‘normal’ people and ad people underestimate the proportion of live viewing that occurs

Consuming TV content comprises of various elements, and TV in all its forms plays a large role in our lives. When looking at the proportion of each component (live, recorded/catch up and SVOD), it provides a more detailed view on how the nation engages with TV.

We investigated the time spent watching TV and further segmented this into each element. Ad people claimed that over half of their time spent watching TV content was spent watching SVOD (53%), with recorded/catch up accounting for 27%, whilst 20% of their time was spent watching live.

The same question was asked to the sample to predict the behaviour of ‘normal’ people. Ad people predicted that SVOD accounted for a smaller share (31%), a similar proportion of their own behaviour was also reflected in recorded/catch up (26%) whilst live TV accounted for 43%. Contrastingly, ‘normal’ people were more equal in their allocation, with SVOD only slightly leading at 36%, whilst live and recorded/catch up accounted for 32% each.

Despite the claimed time spent, actual data from BARB displays a different story. In contrast, live TV accounts for the largest share with 63%, whilst recorded/catch up accounts for 21%. Contrastingly SVOD accounts for the smallest proportion with just 17%. Despite the reported claims, live viewing plays a much larger role in the way TV content is consumed, with both groups considerably underestimating the proportion of live viewing.

3. Ad people have a good feel for the penetration of platforms but overestimate for the new emerging platforms

A general trend uncovered by the data suggests that ad people had significantly higher consumption of certain media such as streaming services. A similar trend was seen in social media. Looking at platforms accessed in the last 3 months, Facebook and YouTube were the most popular services for ‘normal’ people, on the other end of the spectrum, TikTok, Snapchat and Reddit were least popular, with under one-fifth of the sample claiming to have used each of these platforms.

However, when compared with ad people, a different story emerges. Unsurprisingly, LinkedIn in the most popular platform, with Instagram, YouTube, Facebook and Twitter also seeing over 70% of the sample using these social services. Interestingly, 43% of ad people had used TikTok at some point in the past 3 months (over two and a half times more than ‘normal’ people), with Snapchat seeing the least penetration. Ad people consistently had larger usage of social media platforms.

However, as industry professionals, understanding your audience is key! As a group, we are generally at the forefront of technology, we know the ins and outs of the fast paced and evolving landscape. As an industry, ad people are already consuming more social media than the average person, but how well did ad people do when asked to predict the behaviour of ‘normal’ people?

Ad people’s estimates of Instagram, LinkedIn, Twitter, Reddit and Snapchat were around a 10-percentage point margin of the penetration reported by ‘normal’ people. Pinterest estimates were spot on.

However, ad people underestimated the usage of Facebook and YouTube, with 65% of ‘normal’ people claiming to have used YouTube whilst ad people believed this to be far lower at 50%. Similarly, ad people perceived TikTok usage to be two times higher at 35% (close to their own consumption levels), whereas only 17% of ‘normal’ people said they had used the video sharing platform in the last 3 months.

Data suggests that ad people were able to accurately estimate most platforms however it highlights the need to be aware of the claimed penetration of new and emerging services. Whilst their prediction likely mirrors their own greater consumption of social media, this is a great reminder of the differences between the two groups as well as highlighting the issue with projecting our own technological confidence onto the rest of the population.

4. Both groups acknowledge TV as the most trusted, most emotional, and most memorable form of advertising

There is a wealth of effectiveness data that shows how advertising that elicits an emotional response creates a lasting impact. As you would expect, the advertising media channel also plays a part in generating this outcome. The ‘Adnormal Behaviour’ study explored attitudes to advertising to see what channels produce the greatest results.

Analysis shows that TV outperformed all other media and is the leading source of advertising that generated affective outcomes, such as trust, emotion, and entertainment.

More importantly, the data shows that both groups are aligned in their attitudes to advertising. Looking closely at the ranking of media channels, when asked about where they would find advertising that they trust, that makes them feel emotional and draws their attention to a new product, brand or service, TV performed favourably for all statements. Interestingly, newspapers and magazine were supported by the British public, whilst ad people supported cinema and outdoor, which is especially visible when asked about where you would most likely to find trustworthy advertising.

Regarding media channels where emotional advertising was felt to be found, TV was the leading medium for both groups. Interestingly, both groups were also aligned with their selection of media channels, including social media, cinema and YouTube.

Lastly, when asked where they felt they could find advertising that drew their attention to a new brand, product, or service, both ‘normal’ people and ad people selected TV and social media as the most popular medium (albeit with TV leading for ‘normal’ people).

Both groups acknowledge the ability for media channels to make you think, feel and do, with TV being a large source of generating effective results.

In summary

The latest iteration of our comparative study ‘Adnormal behaviour’ reveals the large and increasing role of TV content as well as the way in which people have adapted and adopted the latest technological innovations.

Whilst the study explores the media habits between the public and industry professionals, it uncovers the importance of adland’s ability to understand their audience. Whilst gaps remain in their perceptions and use of social media, ad people do have a close grasp of what ‘normal’ people are consuming, especially in relation to consuming TV content. However, this study also uncovers the inflated predictions of ad people’s perception of ‘normal’ people in areas such as the use of SVOD and TikTok, likely reflecting their own consumption habits and serves as a great reminder to not look at the world through the prism of our own behaviour.

Thinkbox

Thinkbox